Dear reader,

We haven’t had a February report, due to adjustment in dates of publishing in order to be more updated with the export information. Another detail, as we have very few information on exports in 2024, I will analyze below the exports of the crop year.

Overview

Since mid-February, harvesting has commenced in most regions, although with very modest volumes. Early plantings, which endured prolonged periods of drought, have yielded disappointing results in terms of both productivity and quality, particularly concerning aflatoxin levels. Areas like Middle Tiete and Alta Paulista appear to have fared worse than Mogiana, although this one’s performance was not good either.

Recent rainfall has complicated the harvesting process for early growers but brought relief to late growers still awaiting maturation and requiring moisture. It's widely agreed that the bulk of the harvest, roughly 80%, will occur in March and April, offering a clearer picture of the crop's actual outcome.

With indications of a subpar crop, growers have resisted reducing raw material prices, contrary to expectations among shellers at the beginning of the crop. This has raised concerns, especially considering Russia's reluctance to meet prices that would enable shellers to procure the raw material, given its significant share of Brazilian exports.

The EU market presents a more promising prospect, as shellers are able to command considerably higher prices, particularly during periods when Argentina will not be able to supply yet, the difficulty here for the exporters is finding raw material with the needed quality to the EU.

Finally, the viability of the peanut oil market remains constrained by persistently low prices, limiting its potential as a significant consumer of raw material, as observed in the past.

Tables, charts and analyzes below.

I hope this information is useful for you.

Best regards.

Peanuts

Total

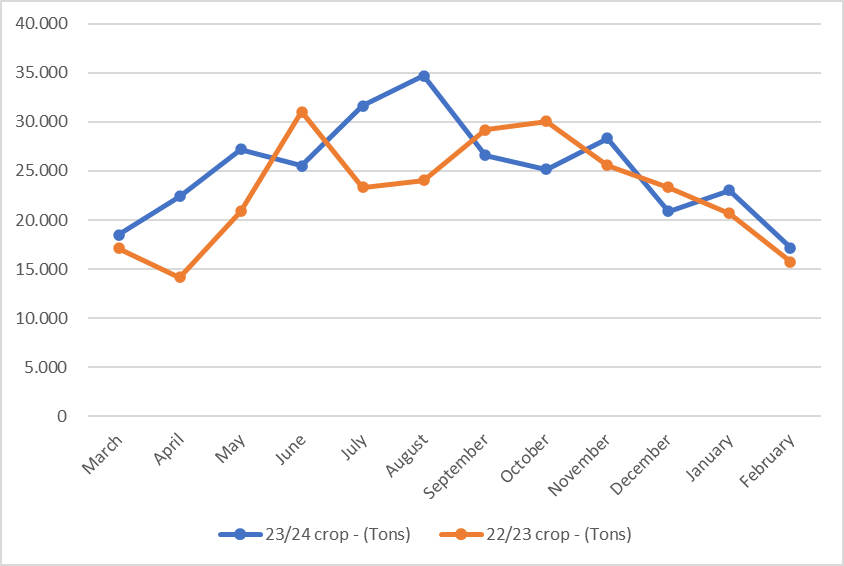

Peanuts export in 2024 x 2023

| Month | 23/24 crop - (Tons) | 22/23 crop - (Tons) | Var (%) |

|---|---|---|---|

| March | 18.472 | 17.132 | 7,82% |

| April | 22.425 | 14.161 | 58,36% |

| May | 27.193 | 20.885 | 30,20% |

| June | 25.542 | 31.055 | -17,75% |

| July | 31.630 | 23.327 | 35,59% |

| August | 34.730 | 24.030 | 44,53% |

| September | 26.620 | 29.200 | -8,84% |

| October | 25.150 | 30.057 | -16,33% |

| November | 28.339 | 25.576 | 10,80% |

| December | 20.889 | 23.324 | -10,44% |

| January | 23.008 | 20.702 | 11,14% |

| February | 17.175 | 15.756 | 9,01% |

| Total | 301.173 | 275.205 | 9,44% |

When looking through the crop perspective, it’s clear to see hat there was an increase of about 10% on the exports on the crop 23/24, in detriment of the 22/23 one.

This certainly is related to the peanut oil market consuming much less raw material, due to the weakened demand from China, as we will be able to see further on the report.

Peanut Oil

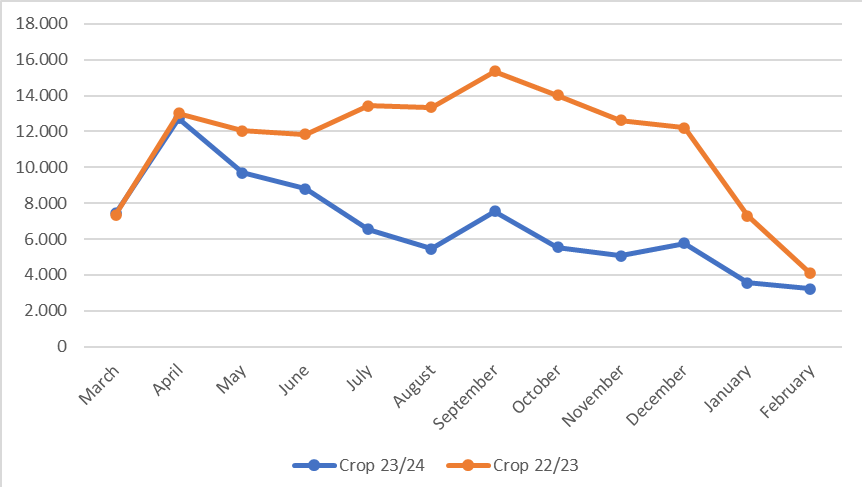

Peanut Oil export in 2024 x 2023

| Month | Crop 23/24 | Crop 22/23 | Var (%) |

|---|---|---|---|

| March | 7.439 | 7.359 | 1,08% |

| April | 12.746 | 13.023 | -2,12% |

| May | 9.706 | 12.045 | -19,42% |

| June | 8.807 | 11.836 | -25,59% |

| July | 6.543 | 13.446 | -51,34% |

| August | 5.456 | 13.364 | -59,17% |

| September | 7.555 | 15.370 | -50,85% |

| October | 5.544 | 14.023 | -60,46% |

| November | 5.062 | 12.625 | -59,90% |

| December | 5.763 | 12.211 | -52,80% |

| January | 3.564 | 7.298 | -51,17% |

| February | 3.232 | 4.092 | -21,02% |

| Total | 81.417 | 136.691 | -40,44% |

Analyzing the crop year, it’s possible to see an even bigger difference between the two last crops, 40% decrease from 22/23 to 23/24, caused by weakened demand in China.

This has caused more availability of raw material for exporters of kernels, helping to increase grain exports.